Secret Bank

2023

Problem

Money conversations are uncomfortable, so we tend to avoid them. Silence, in this case, often results in feelings of inadequaciy, insecurity and partnership strain. In fact, unresolved financial challenges are the reason for 30% of all divorces.

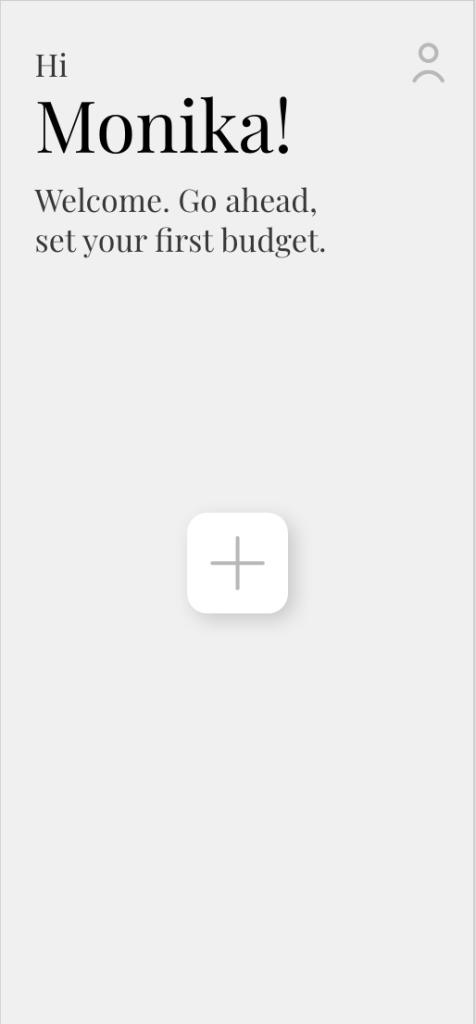

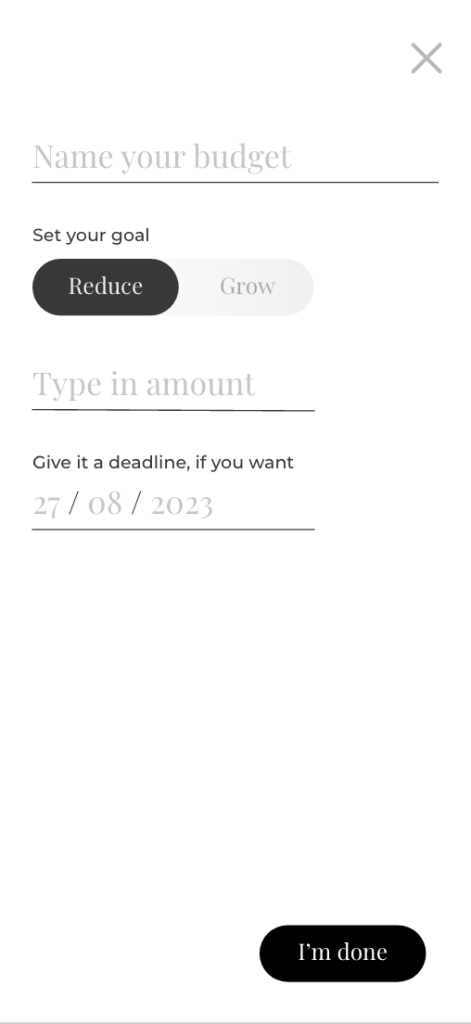

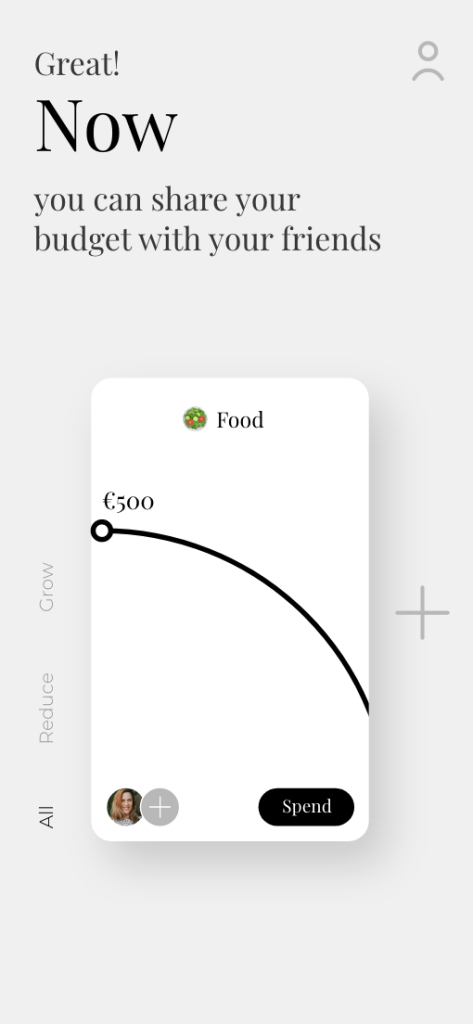

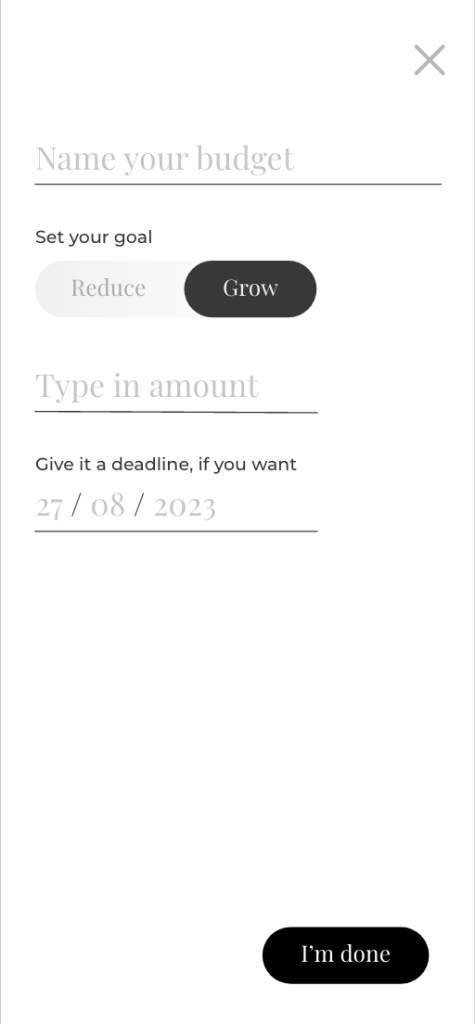

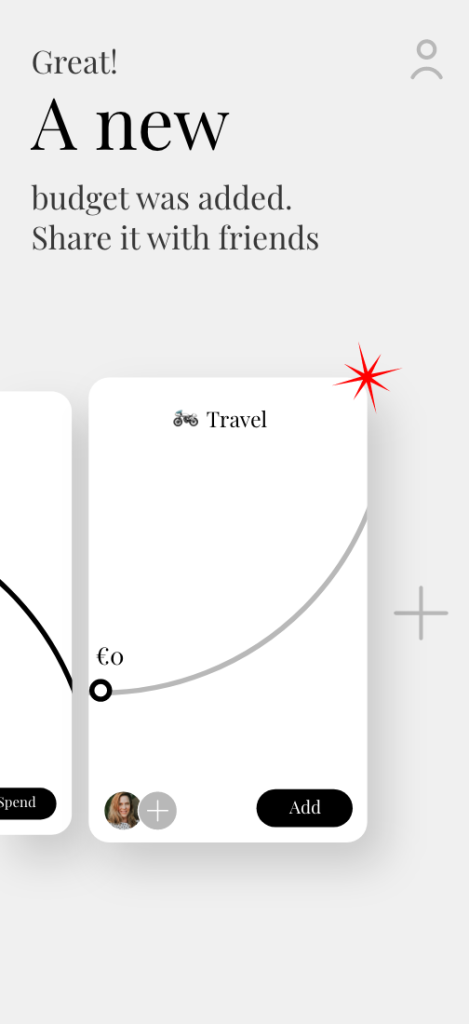

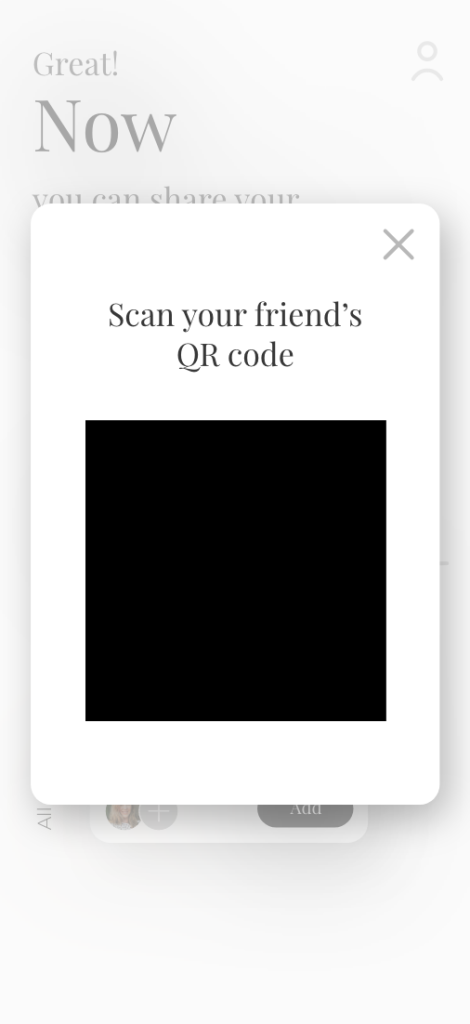

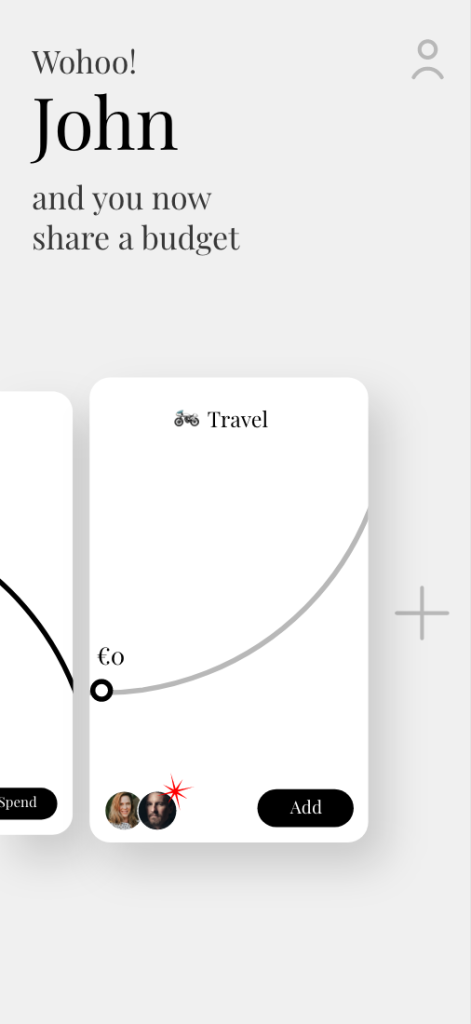

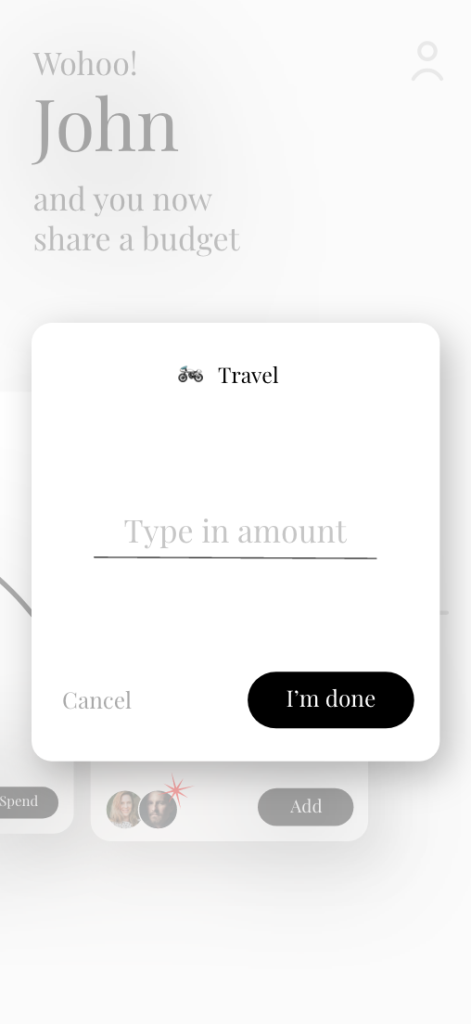

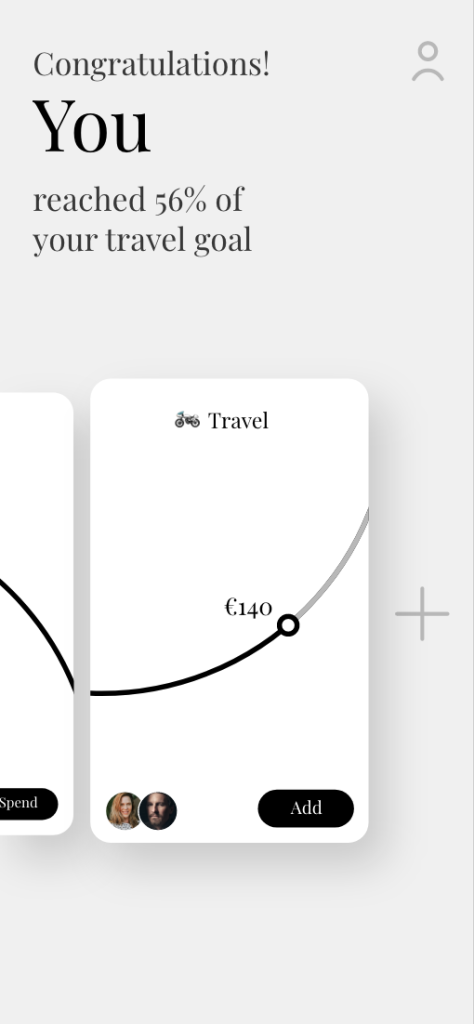

App flows: create a spending budget, add a saving budget and share it with your friends, update budget.

Solution

Research showed that many people have a vague idea about their financial habbits. Often, their mental models are accurate or accurately reflect their habits. Also, there is a clear differenciation between genders. While men tend to live slary to salary, females are often more cautios about their money and set budgets in advance.

The app first nudges users to plan their finances in advance. It allows the user to create different budgets for spending and saving, and set a target budget for each. Record your spending, add to your savings, get weekly reports and reminders while the app cheekily transfers a percentage left from spending to your savings, making sure that you also save when you spend. All budgets are private, unless you decide differently. The budget you create can be shared with your spouse, child or a friend to create a common financial goal and transparency for you both. However, the app does not show individual contribution amount – if a situation is not to your liking, you are forced to have that uncomfortable connversation.